De-risking Options

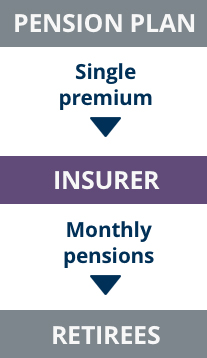

Brookfield Annuity offers companies and DB pension plans of varying sizes a range of options for managing and minimizing risk through group annuity buy-outs, group annuity buy-ins and longevity insurance. We’ll work with you to determine the best choice for your plan.

Longevity Insurance

Longevity insurance is an effective solution for managing the risk associated with increased longevity among a defined group of pension plan members.

People are living healthier and living longer. Since 1901, according to the Office of the Superintendent of Financial Institutions*, the average life expectancy of Canadians has increased by 33 years. That’s a wonderful thing, but it can have a significant impact on pension plans that were established with expectations about longevity that are no longer valid. Longevity insurance offers DB plan sponsors a practical approach to addressing longevity risk.

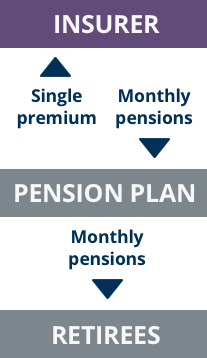

A plan sponsor makes fixed payments to Brookfield Annuity based on the expected lifespan of a designated group of pensioners. In return, we make variable payments to the pension plan based on the actual lifespan of pensioners within this group.

After purchasing longevity insurance, a pension plan retains the other risks associated with pension benefit payments.

*“Living to 100…will the Canada Pension Plan be sustainable?”, OSFI, October 2014